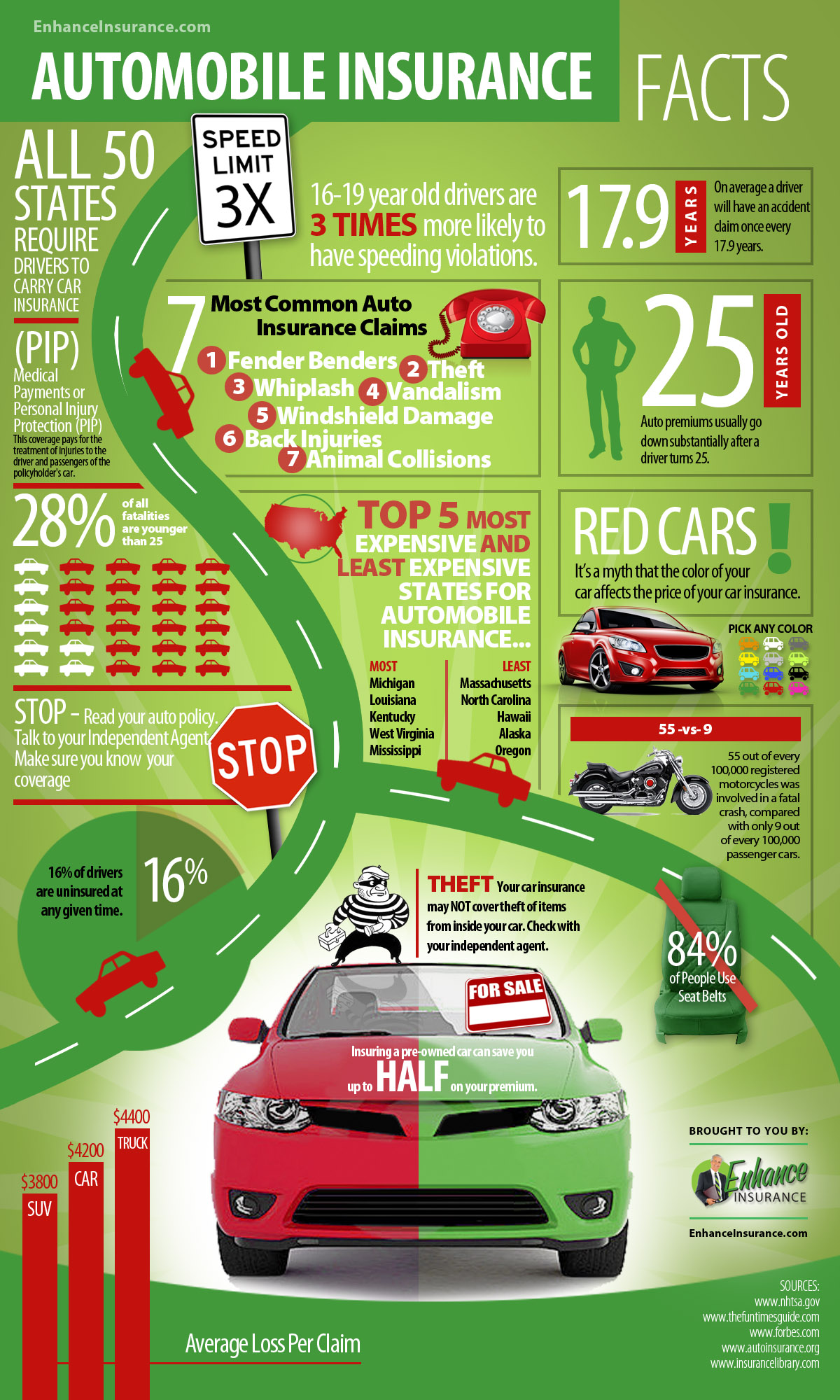

Researches as well as stats reveal that: Young drivers tend to take even more dangers included when they are driving. Young motorists will drive in settings that are taken into consideration to be more of high risk. The young chauffeurs might not be as dedicated to keeping their automobiles in safe operating conditions. Making use of historical data can go back many years.

There is no chance of understanding whether the Insurance business only rely on this data or whether they are privy to more as much as day studies as well as statistics. A Mix of Risk-Taking And Also Lack of Experience, This is a mix that can considerably affect the cost of insurance policy. It is assumed that by the time a young individual gets to the age of twenty-five they have actually advanced into their adult years and also are no more taken into consideration to be the exact same risk-takers that they were prior to this age.

Some may not recognize it yet frequently automobile insurance policy is a little less costly for females contrasted to guys. Two new drivers who coincide age and also have the exact same situations yet are male as well as women will normally see that the lady's costs are a little less expensive. Just How Much Much Less Do 25 Years Of Ages Ladies Spend For Automobile Insurance Coverage? Every Insurer is different however when it involves premiums for women motorists it is indicated that females will pay 5% much less than their male counterparts.

Everything about What Age Does Car Insurance Go Down For Female Drivers?

All of it about their lowering of risk variables that could cause them to need to pay out claims. It indicates that they will meticulously take a look at driving information that relates to ladies after that contrast this versus the very same data collected for the guys. What they have uncovered is: General women do not seem to be associated with accidents as commonly as males do, When females do submit automobile insurance claims they are on average less than those contrasted to me.

Whereas the men often tend to speed a little bit much more. Ladies will certainly obey the website traffic indications much more carefully, Women were a lot more most likely to use their seat belts, Ladies driving statistics reveal that females have much less small website traffic violations, More males are discovered to drive without evidence of insurance policy compared to women.

By how much depends on which one applies. For instance, some insurance provider might believe that not using safety belt is a lot more significant than not following web traffic signs or the other way around. It is this various assumption that triggers the differences in insurance policy costs from one business to another. Historical Information as well as The Motorist's License, While the insurance provider will certainly take right into account historical stats worrying women drivers, this is not the only source they will utilize.

Some Known Factual Statements About Does Car Insurance Go Down At 25? - Bankrate

If this is information on this for a female motorist that puts the Insurance firm in danger then it will certainly trigger the costs to boost simply based upon those alone. There is no control that a person has more than their age when it involves obtaining insurance. Yet, there are lots of various other variables that they can control.

By the time they get to the age of twenty-five they can do so with a tidy driving record that will most likely enable them to appreciate less costly insurance coverage prices.

The beginnings of the misconception, So where did the myth that ranks immediately go down at age 25 come from? The idea is based on data that shows teenager chauffeurs have a tendency to proportionally get into even more accidents than their older counterparts.

Your Guide To Automobile Insurance - State Of Michigan Can Be Fun For Everyone

But does being 25 really make a distinction versus, say, being 23 or 24? There's no information to suggest that at 25, individuals are instantly much safer chauffeurs. The majority of the information that reveals the 16-24 age brace is one of the most reckless is likely being altered by the 16-19 team, offered that these are brand-new vehicle drivers just figuring out the road and also likely to make one of the most mistakes.

Instead, insurance companies will certainly consider a variety of variables that affect asserts the kind of auto you drive (some cars and trucks are a lot more expensive to fix), your driving history, and your place (burglaries often tend to be higher in some locations than others). Age issues, yet there's no wonderful 25 discount, Age, naturally, is always a factor to consider.

If you're hoping to save money on automobile insurance coverage, it's important to initially understand how your costs is identified, and also exactly how dramatically these premiums can vary. Below are some of the factors that can affect exactly how much you pay: Your driving document Your record plays an essential function in establishing costs.